25+ tax on mortgage payments

Web Use our free mortgage calculator to estimate your monthly mortgage payments. Ad For Simple Returns Only.

Ndmc Property Tax Pay Ndmc House Tax Online Bajaj Finserv

Ad Learn More About Mortgage Preapproval.

. Looking For Conventional Home Loan. Comparisons Trusted by 55000000. Lenders often roll property taxes into borrowers monthly mortgage bills.

Web Paying Taxes With a Mortgage. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. The cost of the loan.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Compare Lenders And Find Out Which One Suits You Best. If youre buying a house and need.

Browse Information at NerdWallet. Web A good gauge to tell if you can afford a mortgage is if the monthly payments are no more than 25 of your monthly take-home pay. Use NerdWallet Reviews To Research Lenders.

Web The traditional monthly mortgage payment calculation includes. While private lenders who offer conventional loans. Web The 25 Post-Tax Model.

Web Basic income information including amounts of your income. The outlook for next year. Web Low-Down Mortgages.

Web Mortgage insurance payments are tax deductible through 2021 but the deductions phase out if your adjusted gross income exceeds 100000 50000 for married people filing. Mortgage programs which require a minimal down payment. Web The amount you pay is deductible and should show up on your Form 1098 from your mortgage company.

The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage. Get Live Help From Tax Experts Plus A Final Review Before You File - All Free. Web Your mortgage payment calculation should include principal interest taxes and insurance PITI as well as any HOA PMI or MIP payments.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Your take-home pay is. Dave Ramsey states that you should limit your mortgage payment to no more than 25 of your monthly take-home pay.

Ad 5 Best Home Loan Lenders Compared Reviewed. Principal interest taxes and insurance. Most low-down mortgages require a down payment of between 3 - 5 of.

The amount of money you borrowed. Web 18 hours agoKey points. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The private mortgage insurance just. See If You Qualify To File 100 Free w Expert Help. Account for interest rates and break down payments in an easy to use amortization schedule.

Take Advantage And Lock In A Great Rate.

Are Property Taxes Included In Mortgage Payments Smartasset

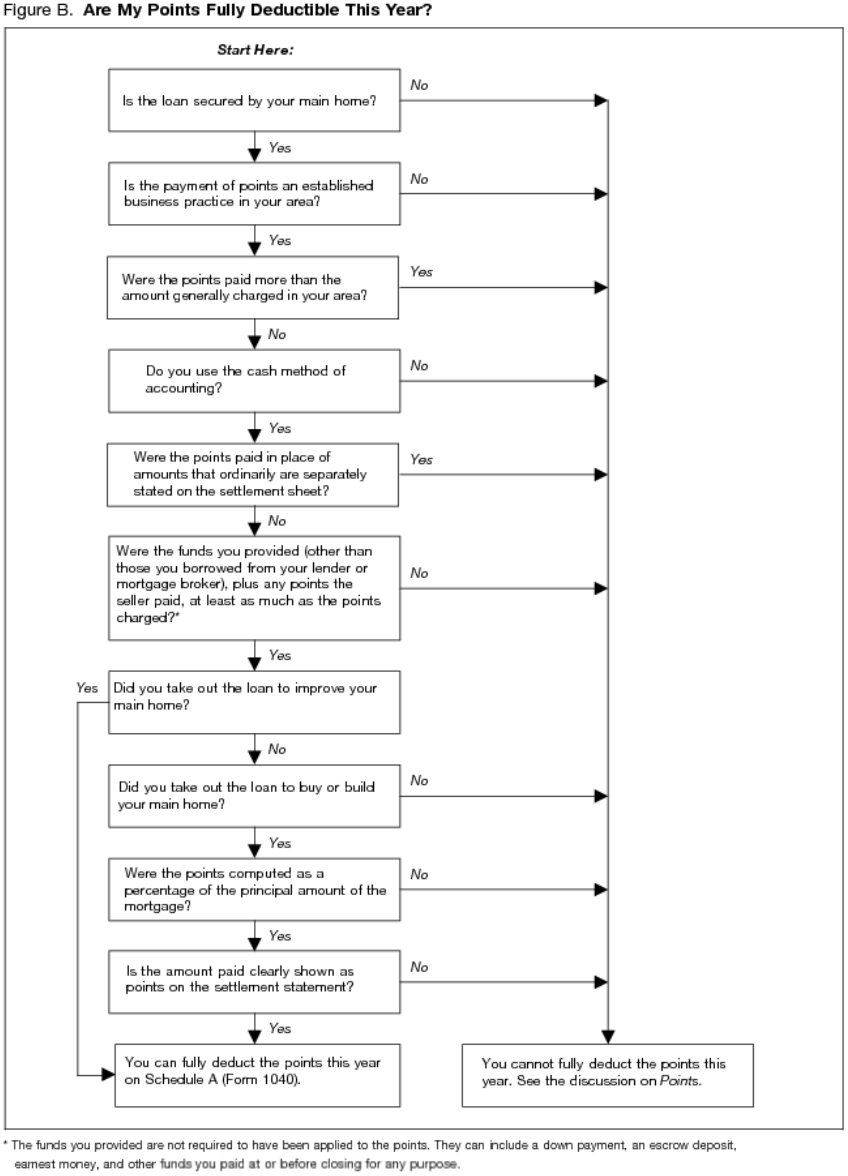

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

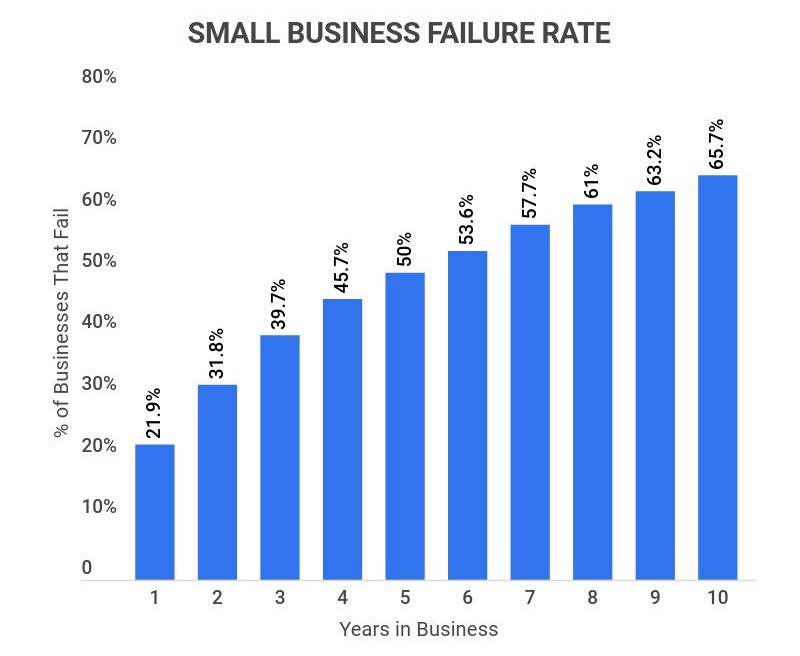

25 Essential Small Business Lending Statistics 2023 What Percentage Of Sba Loans Get Approved Zippia

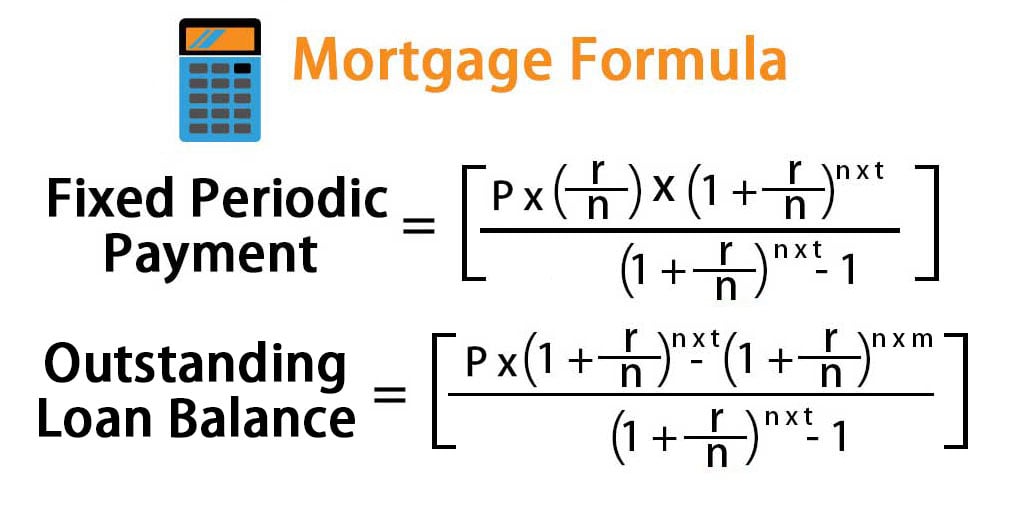

Mortgage Formula Examples With Excel Template

Complyright 1098 Tax Forms Laser Pack Of 25 6108e Quill Com

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

G145441mmi003 Jpg

Mortgage Interest Tax Relief Changes Explained Taxscouts

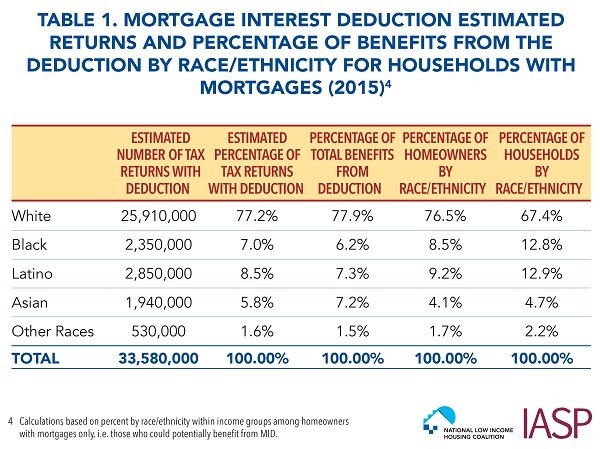

Race And Housing Series Mortgage Interest Deduction

Jepi To Pay Rent Mortgage R Jepi

Tax Shield Formula How To Calculate Tax Shield With Example

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

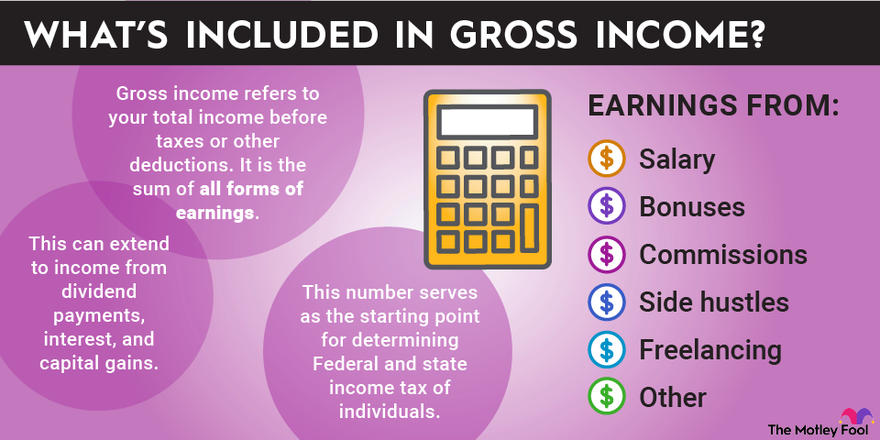

How To Calculate Gross Income Per Month The Motley Fool

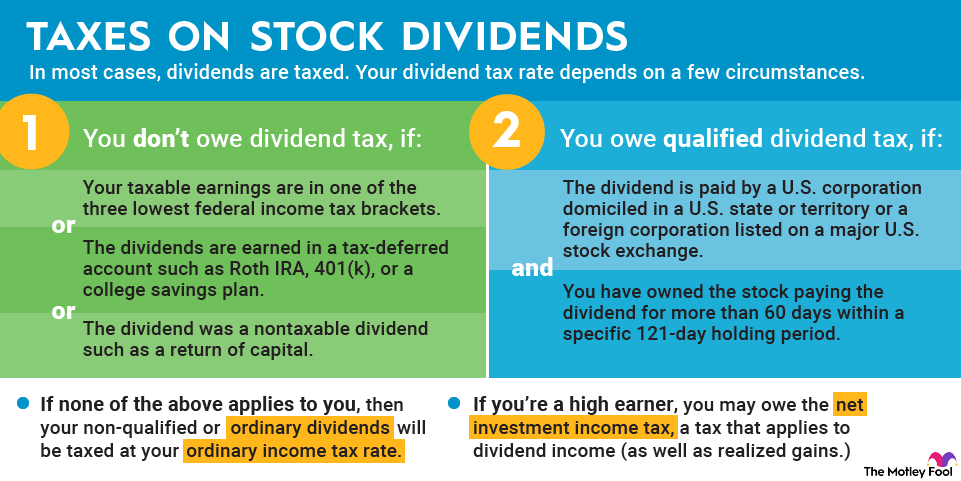

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

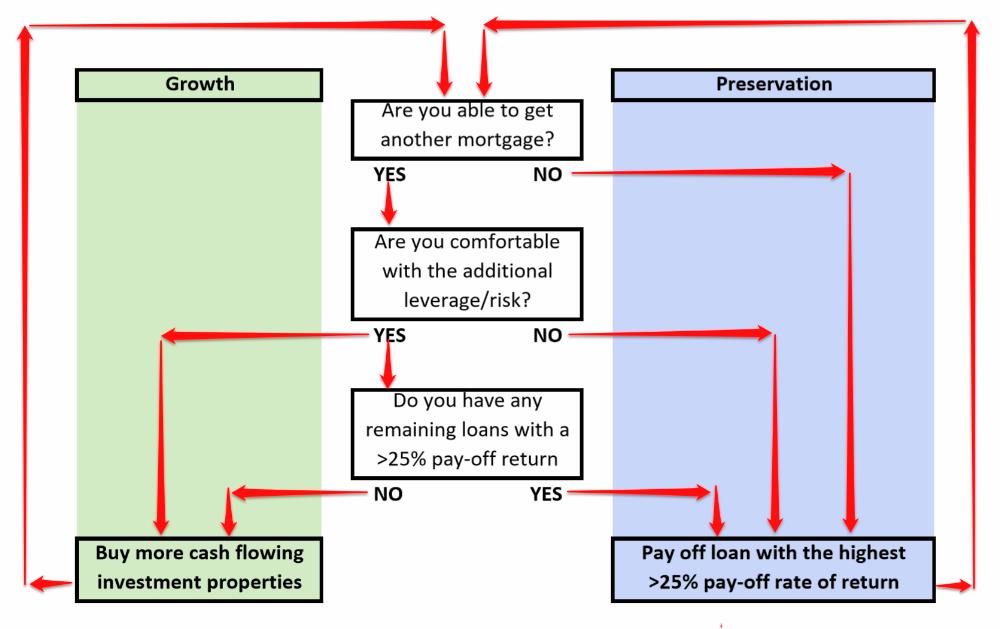

Should I Pay Down Or Pay Off My Mortgage Or Should I Buy More Investment Properties

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage